New:

New:

Sovereign Probability of Default Model

Sovereign Probability of Default Model

Emerging

Emerging

markets,

markets,

connected.

connected.

Unique insights and data made accessible with a proprietary AI platform to help investment professionals make better decisions on 170+ Emerging and Frontier economies.

Unique insights and data made accessible with a proprietary AI platform to help investment professionals make better decisions on 170+ Emerging and Frontier economies.

Trusted by the world’s largest institutions

Trusted by the world’s largest institutions

Trusted by the world’s largest institutions

New:

Sovereign Probability of Default Model

platform: content

Unique data and analysis.

Sovereign Probability of Default

New

Our proprietary Sovereign Probability of Default Model correctly predicted 26 of the last 28 sovereign Eurobond defaults.

Sovereign & Macro

Corporate Credit

Equity

Our network

Sovereign & Macro

Sovereign Probability of Default

New

Unique insights from Tellimer's in-house team of economists, data scientists, geopolitical risk analysts, and quantitative analysts, covering sovereign debt analysis, research, and data on Emerging and Frontier countries.

Our proprietary Sovereign Probability of Default Model correctly predicted 26 of the last 28 sovereign Eurobond defaults.

Sovereign & Macro

Unique insights from Tellimer's in-house team of economists, data scientists, geopolitical risk analysts, and quantitative analysts, covering sovereign debt analysis, research, and data on Emerging and Frontier countries.

Sovereign & Macro

Unique insights from Tellimer's in-house team of economists, data scientists, geopolitical risk analysts, and quantitative analysts, covering sovereign debt analysis, research, and data on Emerging and Frontier countries.

Corporate Credit

Tellimer analysts provide deep dive research on corporate debt issuers across Emerging and Frontier countries.

Equity

Tellimer provides research, data and news on more than 27,000 companies globally and joined-up equity portfolio strategy research on over 50 Emerging and Frontier countries.

Our network

Access hard to find insights from research sources on the ground in Frontier and Emerging Markets, digitised and searchable.

platform: features

A powerful, intuitive platform

AI supported decision making

AI to support your decision making

Curate your information requirements to fit your workflow, using Tellimer's intuitive AI powered platform.

AI Search & Q&A

Tellimer's GenAI research assistant, Idris, answers questions, generates tables and identifies data from millions of pro-grade research and data points.

Comparison tools

Compare countries, sectors and companies side by side across key metrics.

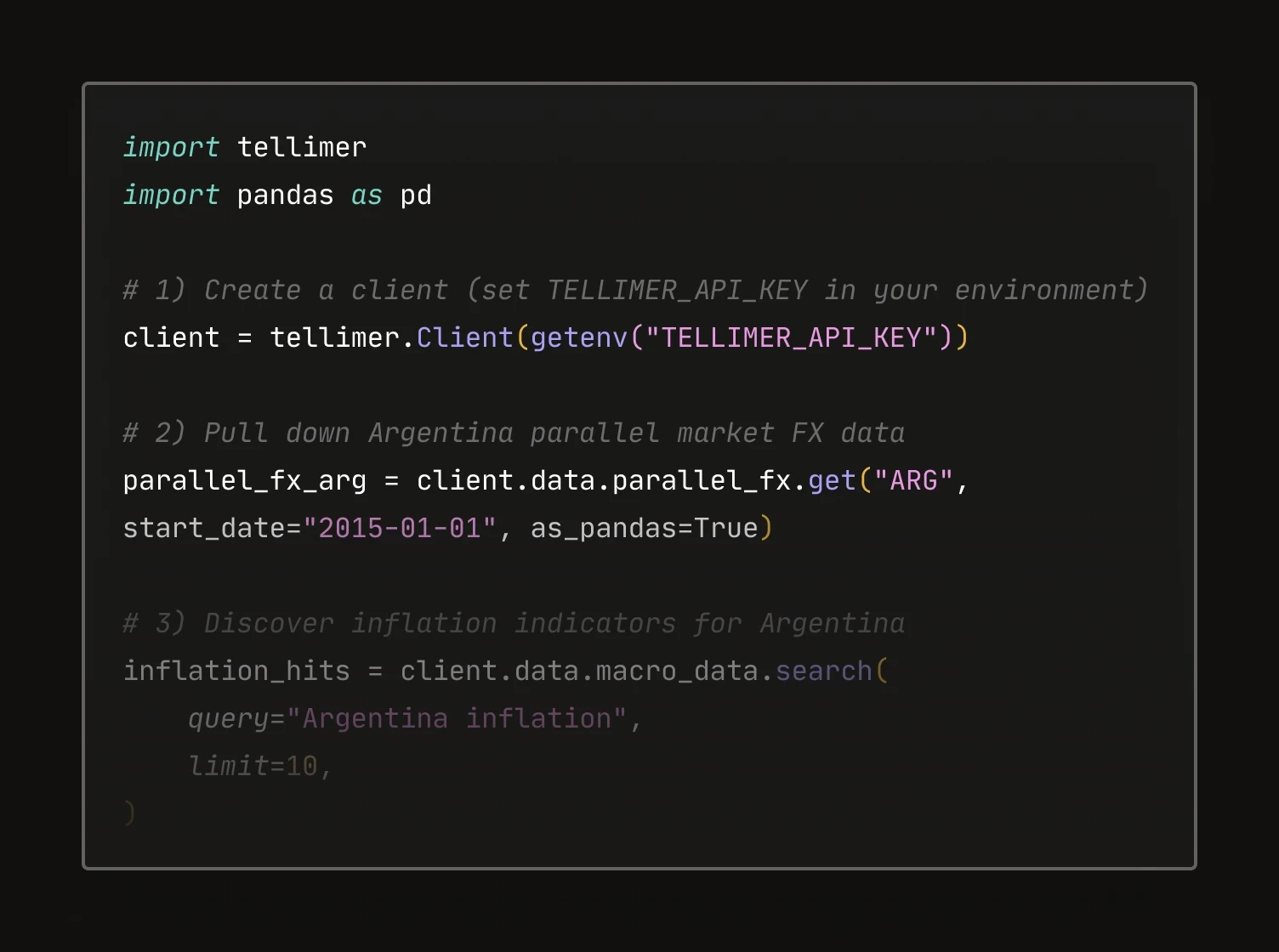

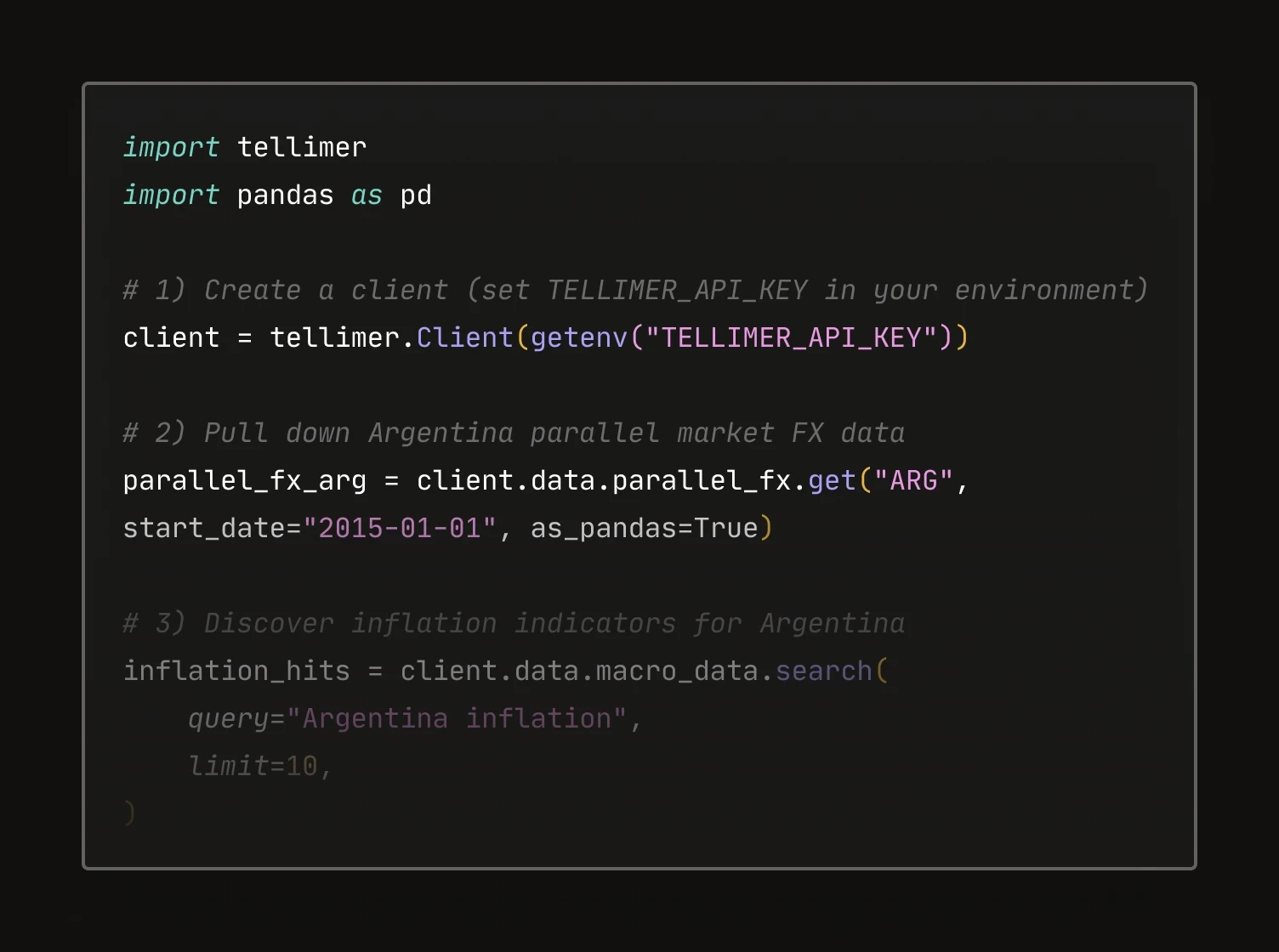

Tellimer Python SDK

Access macro and parallel FX time series in Python. Search indicators by plain text, fetch country-level data, and get clean, pandas-ready DataFrames for your models.

Tellimer Excel Add-in

Pull sovereign and macro data straight into Excel. Search Tellimer's proprietary and third-party datasets, and power your models — without leaving your spreadsheet.

Additional features

Comparison tools

The Tellimer platform provides you all the components required to analyse and understand the economics, geopolitical dynamics, risks and opportunities in the developing countries.

The Tellimer platform provides you all the components required to analyse and understand the economics, geopolitical dynamics, risks and opportunities in the developing countries.

Curated alerts in your inbox

Advanced filtering

Excel Add-in for data

Yield curves

Credit ratings

Parallel FX Rates

Translated local news

Event replays

Searchable event transcripts

Direct analyst interactions

Access to the IMF Meetings

Solutions

Tellimer

supports

professionals

making

consequential

decisions

in

emerging

and

frontier

markets.

Solutions

Tellimer

supports

professionals

making

consequential

decisions

in

emerging

and

frontier

markets.

Solutions

Tellimer

supports

professionals

making

consequential

decisions

in

emerging

and

frontier

markets.

Testimonials

Professionals depend on Tellimer

Amundi

“

Tellimer’s analysis on EM markets is timely, concise, thoroughly analysed with clear views. They cover lots of frontier markets which are not well covered by the rest of the industry. Their analysts are knowledgeable and approachable. The website is very easy to navigate. I particularly like new data feature on their website which has the IMF arrangements and other macro data at my finger tips.

”

Esther Law

Senior Portfolio Manager @ Amundi

Aegon

“

Tellimer has been an excellent resource for us. Their analysts put together timely and helpful updates, conference calls, independent research, analysis, and recommendations that assist in developing our views. Their analysts also host events around the regular IMF meetings, allowing clients to have access to both IMF and country reps, which greatly aids in developing an assessment of each sovereign’s situation. Finally, the Tellimer web site is also an important resource for checking out current and previous research, as well as news, data, and other resources. Highly recommended!

”

Alan Buss, CFA

Senior Sovereign Analyst @ Aegon

Aberdeen

“

Tellimer’s depth of coverage in frontier markets is unparalleled. As a house with a frontier bias, we rely on their product for insights into the various markets that we cover. We also very much appreciate the thematic research which Tellimer provides, as that provides us with fantastic comparative research which can influence our investment decisions.

”

Edwin Gutierrez

Head of Emerging Market Sovereign Debt @ Aberdeen

Mosaic Insurance

“

Underwriting models for political risk insurers are often driven by lagged data and slow-moving ratings from agencies. We’re constantly looking for ways to overlay models with more current information and analysis, particularly from financial markets. Tellimer is our best connection to that data, consistently providing useful statistics and original analysis to provide advance notice on developing risks around the world.

”

Finn McGuirk

Head of Political Risk @ Mosaic Insurance

Acre Capital

“

As an investor focused on African sovereign credit, I rely on Tellimer’s regional intelligence; it's sharp, timely, and insightful. Their AI agent, Idris, is a real game-changer: it saves me time by delivering fast, reliable context across EM topics, all backed by high-quality research, news, and macro analysis.

”

Faisal Khan

Managing Partner @ Acre Capital

Amundi

“

Tellimer’s analysis on EM markets is timely, concise, thoroughly analysed with clear views. They cover lots of frontier markets which are not well covered by the rest of the industry. Their analysts are knowledgeable and approachable. The website is very easy to navigate. I particularly like new data feature on their website which has the IMF arrangements and other macro data at my finger tips.

”

Esther Law

Senior Portfolio Manager @ Amundi

Aegon

“

Tellimer has been an excellent resource for us. Their analysts put together timely and helpful updates, conference calls, independent research, analysis, and recommendations that assist in developing our views. Their analysts also host events around the regular IMF meetings, allowing clients to have access to both IMF and country reps, which greatly aids in developing an assessment of each sovereign’s situation. Finally, the Tellimer web site is also an important resource for checking out current and previous research, as well as news, data, and other resources. Highly recommended!

”

Alan Buss, CFA

Senior Sovereign Analyst @ Aegon

Aberdeen

“

Tellimer’s depth of coverage in frontier markets is unparalleled. As a house with a frontier bias, we rely on their product for insights into the various markets that we cover. We also very much appreciate the thematic research which Tellimer provides, as that provides us with fantastic comparative research which can influence our investment decisions.

”

Edwin Gutierrez

Head of Emerging Market Sovereign Debt @ Aberdeen

Mosaic Insurance

“

Underwriting models for political risk insurers are often driven by lagged data and slow-moving ratings from agencies. We’re constantly looking for ways to overlay models with more current information and analysis, particularly from financial markets. Tellimer is our best connection to that data, consistently providing useful statistics and original analysis to provide advance notice on developing risks around the world.

”

Finn McGuirk

Head of Political Risk @ Mosaic Insurance

Acre Capital

“

As an investor focused on African sovereign credit, I rely on Tellimer’s regional intelligence; it's sharp, timely, and insightful. Their AI agent, Idris, is a real game-changer: it saves me time by delivering fast, reliable context across EM topics, all backed by high-quality research, news, and macro analysis.

”

Faisal Khan

Managing Partner @ Acre Capital

Amundi

“

Tellimer’s analysis on EM markets is timely, concise, thoroughly analysed with clear views. They cover lots of frontier markets which are not well covered by the rest of the industry. Their analysts are knowledgeable and approachable. The website is very easy to navigate. I particularly like new data feature on their website which has the IMF arrangements and other macro data at my finger tips.

”

Esther Law

Senior Portfolio Manager @ Amundi

Aegon

“

Tellimer has been an excellent resource for us. Their analysts put together timely and helpful updates, conference calls, independent research, analysis, and recommendations that assist in developing our views. Their analysts also host events around the regular IMF meetings, allowing clients to have access to both IMF and country reps, which greatly aids in developing an assessment of each sovereign’s situation. Finally, the Tellimer web site is also an important resource for checking out current and previous research, as well as news, data, and other resources. Highly recommended!

”

Alan Buss, CFA

Senior Sovereign Analyst @ Aegon

Aberdeen

“

Tellimer’s depth of coverage in frontier markets is unparalleled. As a house with a frontier bias, we rely on their product for insights into the various markets that we cover. We also very much appreciate the thematic research which Tellimer provides, as that provides us with fantastic comparative research which can influence our investment decisions.

”

Edwin Gutierrez

Head of Emerging Market Sovereign Debt @ Aberdeen

Mosaic Insurance

“

Underwriting models for political risk insurers are often driven by lagged data and slow-moving ratings from agencies. We’re constantly looking for ways to overlay models with more current information and analysis, particularly from financial markets. Tellimer is our best connection to that data, consistently providing useful statistics and original analysis to provide advance notice on developing risks around the world.

”

Finn McGuirk

Head of Political Risk @ Mosaic Insurance

Acre Capital

“

As an investor focused on African sovereign credit, I rely on Tellimer’s regional intelligence; it's sharp, timely, and insightful. Their AI agent, Idris, is a real game-changer: it saves me time by delivering fast, reliable context across EM topics, all backed by high-quality research, news, and macro analysis.

”

Faisal Khan

Managing Partner @ Acre Capital

events

Events, webinars and podcasts

Access the IMF Spring and Annual Meetings, have direct interactions with analysts and experts in the Tellimer network.

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform

Power up your EM analysis

Unique data & analysis

EM focus

Powerful platform